charitable deduction calculator|goodwill donation calculator spreadsheet : Pilipinas Bunching and Tax Savings Calculator. Pick your 2024 filing status and the corresponding standard deduction¹: Single. $14,600. Head of Household. $21,900. Married Filing Separately. $14,600. Married Filing Jointly. Time conversion from Central European Time (+1) to Philippine Time(+8). CET to PHT time zones converter, calculator, table and map. Savvy Time World Clock. Home; . Best time for a conference call or a meeting is between 8am-11am in CET which corresponds to 3pm-6pm in PHT. 10:30 pm 22:30 Central European Summer Time (CEST). Offset UTC .

charitable deduction calculator,Calculate savings. The Charitable Giving Tax Savings Calculator demonstrates the tax savings power of your charitable giving. Use our interactive tool to see how giving can .Bunching and Tax Savings Calculator. Pick your 2024 filing status and the corresponding standard deduction¹: Single. $14,600. Head of Household. $21,900. Married Filing Separately. $14,600. Married Filing Jointly.Charitable Contribution Calculators & Tools. These tools will help you better understand how to use charitable giving as part of your investment portfolio.goodwill donation calculator spreadsheetCredits, deductions and income reported on other forms or schedules. Accurately track and value items you donate to charities with ItsDeductible™ plus other donations such as cash, mileage, and stocks .

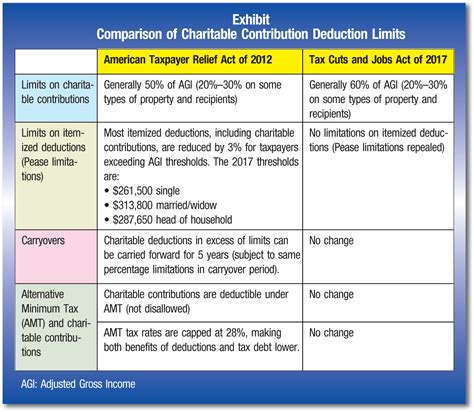

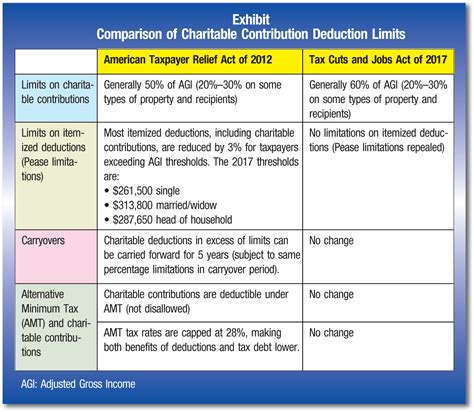

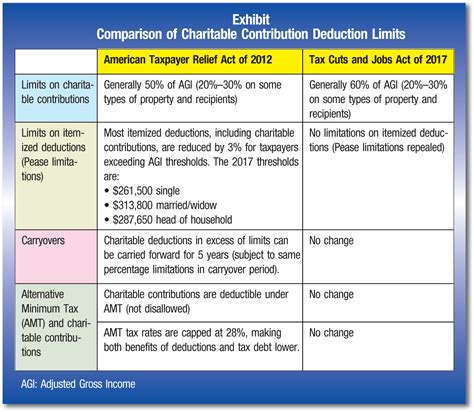

charitable deduction calculator The Bottom Line. Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040. The limit on charitable cash contributions is 60% of the taxpayer's adjusted gross .

charitable deduction calculator goodwill donation calculator spreadsheet The Bottom Line. Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040. The limit on charitable cash contributions is 60% of the taxpayer's adjusted gross .

Calculate the potential tax savings from charitable donations in the US. Enter the donation amount, the standard deduction, and the marginal tax rate to estimate the net cost of .

Use our tools and calculators to help increase your charitable impact. Identify tax advantages with the securities donation calculator or find an asset allocation pool.

charitable deduction calculator|goodwill donation calculator spreadsheet

PH0 · irs charitable contribution calculator

PH1 · goodwill itemized donation calculator form

PH2 · goodwill donation calculator spreadsheet

PH3 · goodwill donation calculator 2022

PH4 · goodwill charitable deductions calculator

PH5 · charitable remainder trust calculator free

PH6 · charitable deduction table

PH7 · charitable contributions if you take standard

PH8 · Iba pa